Understanding Your FICO Score

The main determining factor when it comes to qualifying for a loan is your FICO score. According to myFico.com, FICO scores are used in over 90% of lending transactions within the United States.

What is a good FICO score?

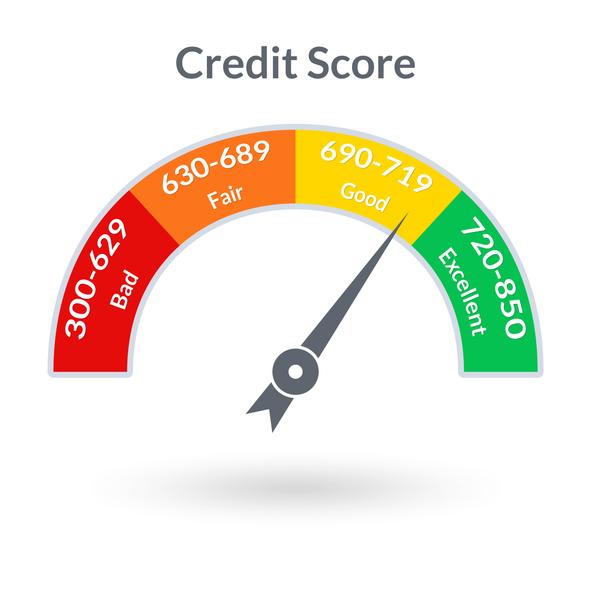

Each lender has its own score it considers to be good, as well as the minimum score required to lend. Better scores may allow the borrower to take on a higher loan amount and/or a lower interest rate because higher scores indicate that the borrower is credible. There are five different levels of credit according to myFico.com: poor (less than 580), fair (580-669), good (670-739), very good (740-799) and exceptional (800 and above).

How is a FICO score calculated?

In the United States, there are three main credit bureaus: Equifax, Experian, and TransUnion. Your credit score from each bureau is bound to be slightly different. MyFico.com bases FICO scores on five different factors, some weighted more than others. Below, you can see the different categories and their impact on a score.

- Payment history is the repayment of past debts.

- Amounts owed considers how much available credit you have used. The closer you come to reaching your credit limit, the more a score decreases. However, don’t let that alarm you and shy you away from using your credit card, as you’ll want to use some credit to prove you’re a worthy borrower who can pay back the debt.

- Length of credit history is based on how long each credit line has been open. The longer the credit history, the more accurate picture a lender has of their potential borrowers. A person who has had an account for fifteen years and is always current will have a higher score than a person who just opened an account 5 months ago but is also current.

- New credit is based on how many accounts a borrower opens, and the frequency these accounts are opened. If too many accounts are opened in a short period of time, this could be an indication of financial instability.

- Credit mix takes all of your debts into account and how payment to each of these accounts is handled. For example, someone who is current with school loans, a car loan and a home loan demonstrate they can manage their money and their debt and is a trusted borrower (MyFico.com).

To ensure your FICO score stays high, be sure to stay current on your payments. Late payments will decrease your score. Many lenders have payment options available so be sure to utilize them if needed.

If you’re searching for a mortgage lender or looking to refinance your current home, contact someone from our team.

Discover Your Mortgage Options

If you’re thinking of buying a home or refinancing, we’re here to help. Start the loan process from right where you are.